Car subscription services are shifting gears in how people think about owning a vehicle. Instead of buying or leasing, drivers pay a monthly fee to access a car — often with insurance, maintenance, and the option to swap vehicles included. It's flexible, commitment-light, and built for convenience.

To see if Americans are ready to hand over the keys to traditional ownership, we looked at who's most open to subscribing, what they're willing to pay, and how brand and vehicle preferences play into the decision.

Key Takeaways

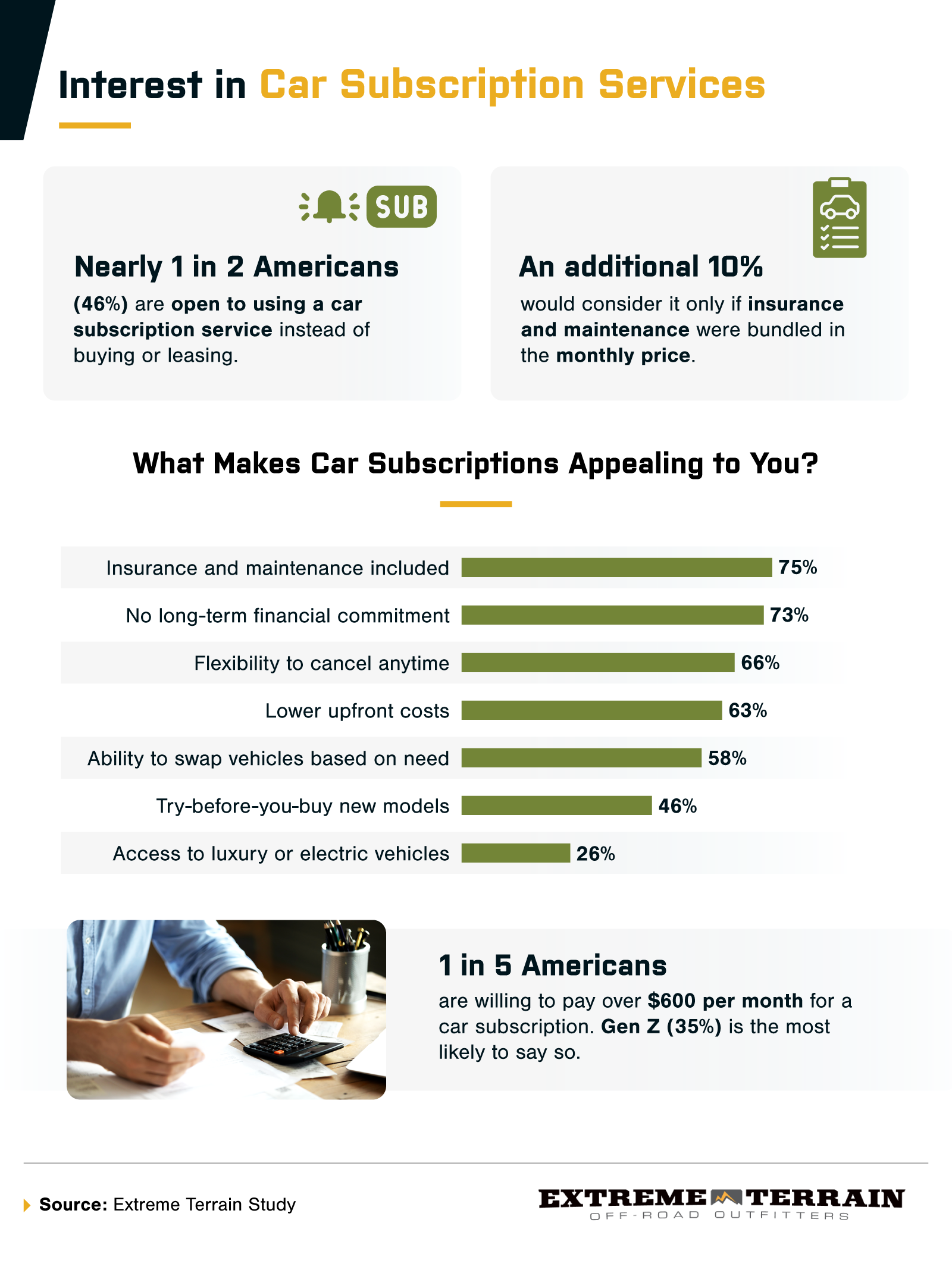

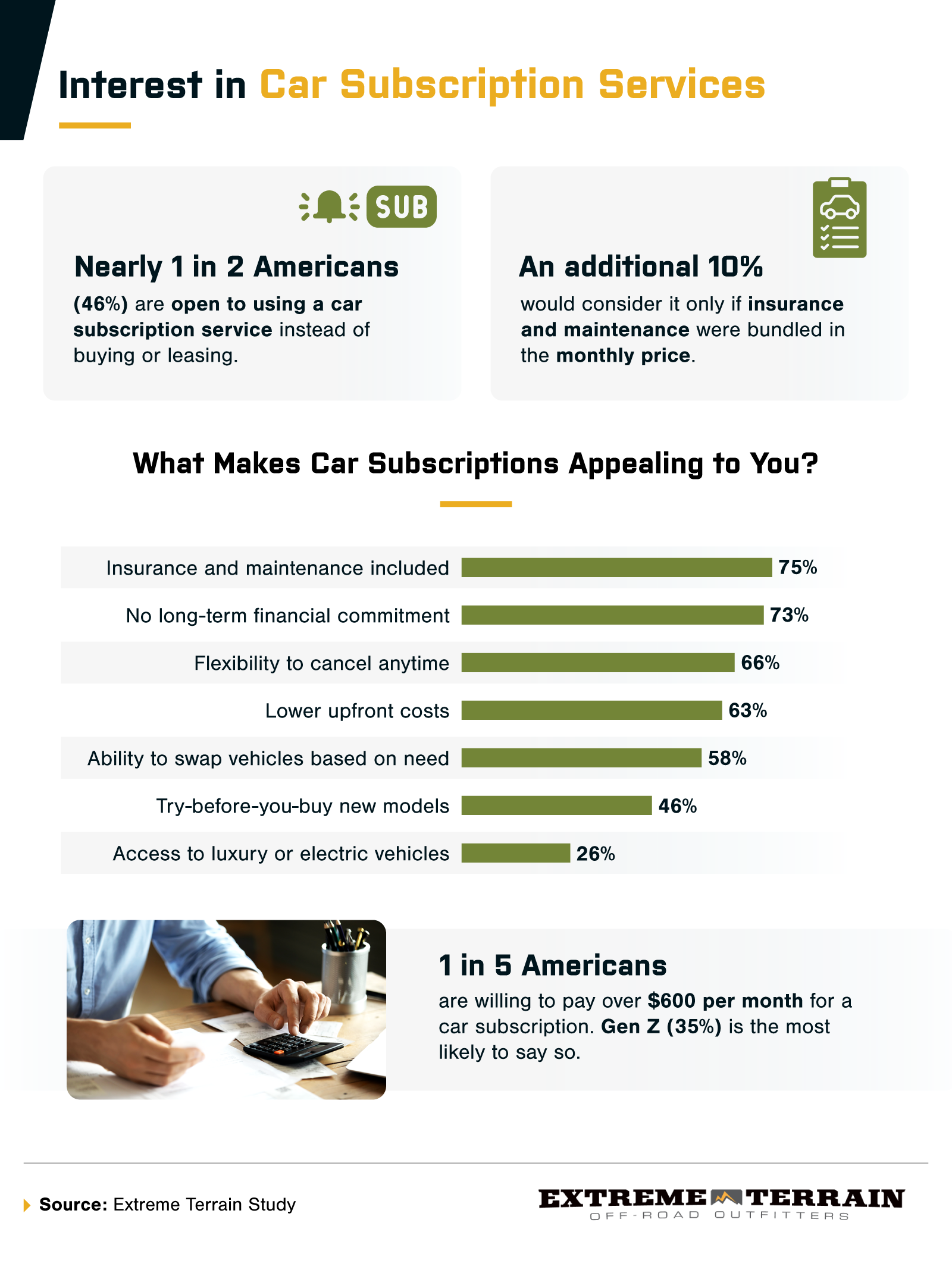

- Nearly 1 in 2 Americans would consider a car subscription over buying or leasing, with another 10% open to it only if insurance and maintenance were included.

- 1 in 5 Americans are willing to pay over $600 per month for a car subscription. Gen Z (35%) are the most likely to say so.

- Over 1 in 3 Americans would want to swap vehicles at least every 6 months.

- Nearly half (46%) would be more likely to explore car subscription services if tariffs caused traditional vehicle prices to rise.

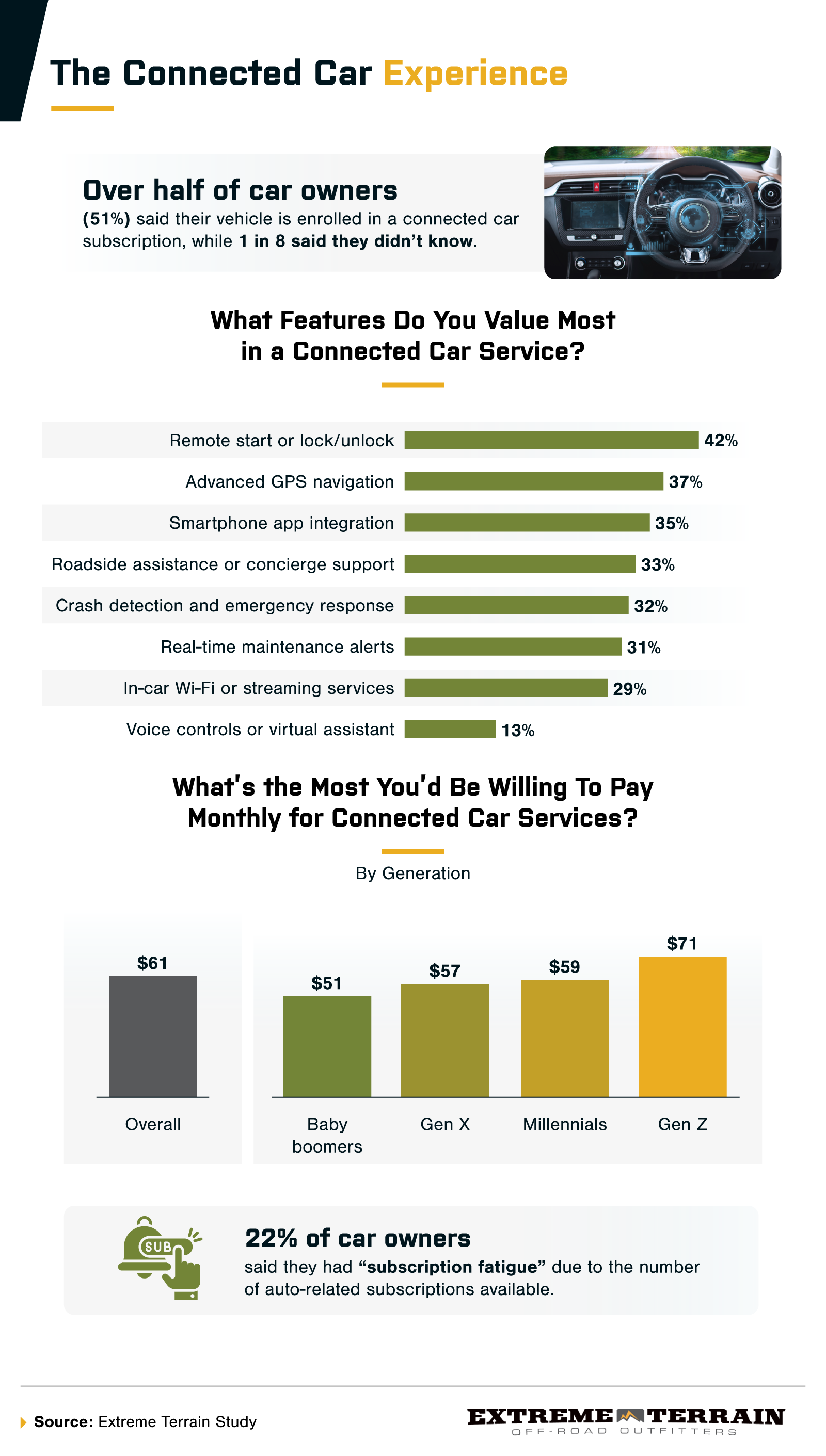

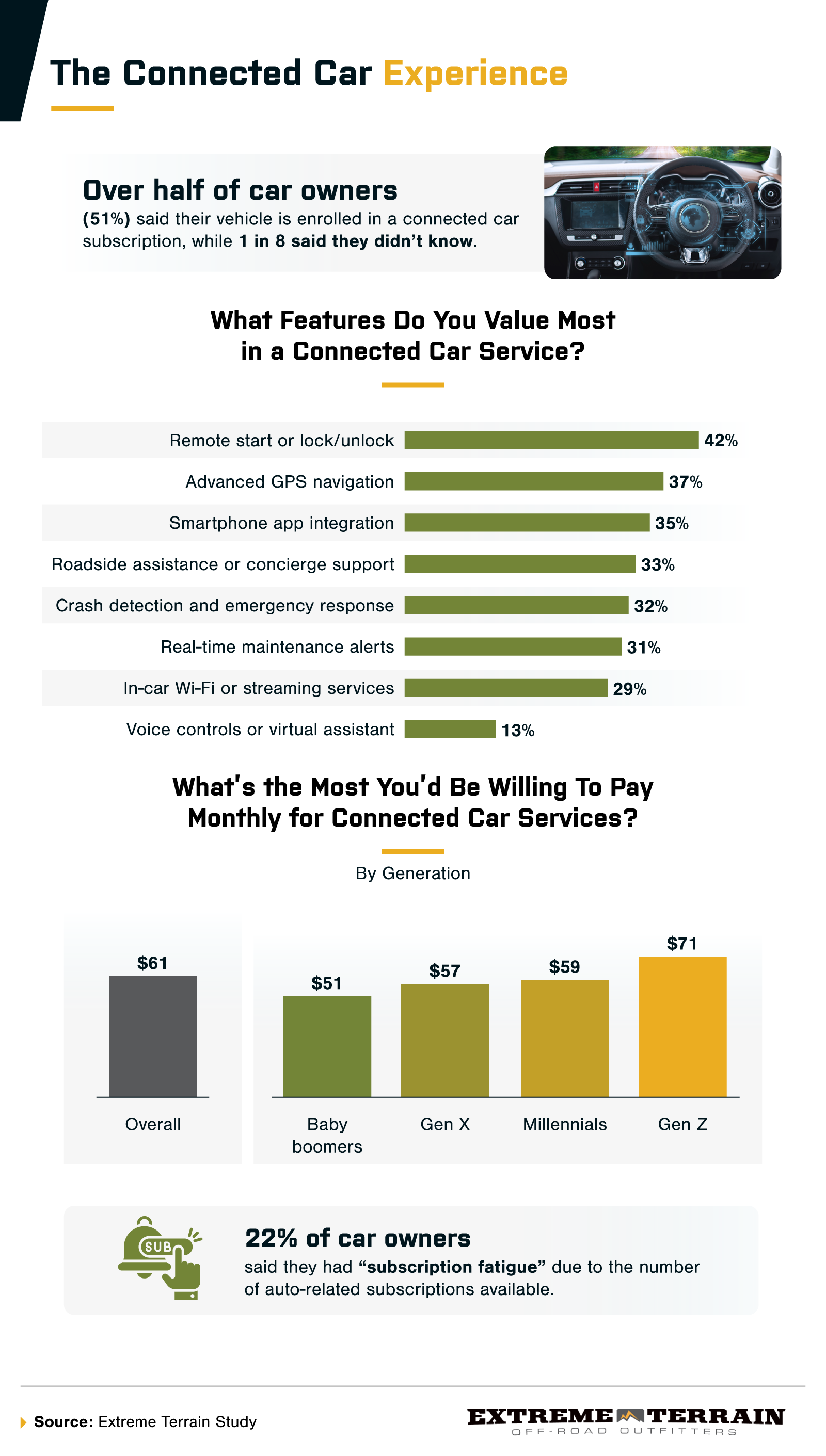

- 22% of drivers are feeling subscription fatigue from the growing number of connected car features, such as navigation, remote start, and in-car Wi-Fi.

Who's Ready to Subscribe to Their Ride?

Americans are warming up to the idea of car subscriptions, especially if they get perks like covered maintenance and the ability to change cars every few months. Here's a look at who's most interested in this new way to drive and what they want out of the deal.

Nearly half of Americans said they'd consider a car subscription service instead of buying or leasing. Another 10% would be on board if insurance and maintenance were included in the monthly fee. Women showed slightly more interest than men (49% vs. 45%). Baby boomers were the most open to subscribing to a vehicle (55%), followed by Gen Z and millennials (46% each) and Gen X (45%).

When it comes to budget, 1 in 5 Americans would be willing to shell out over $600 a month for a car subscription. Gen Z drivers were the most willing to pay that much (35%), while just 15% of Gen X and millennials and 11% of baby boomers said the same.

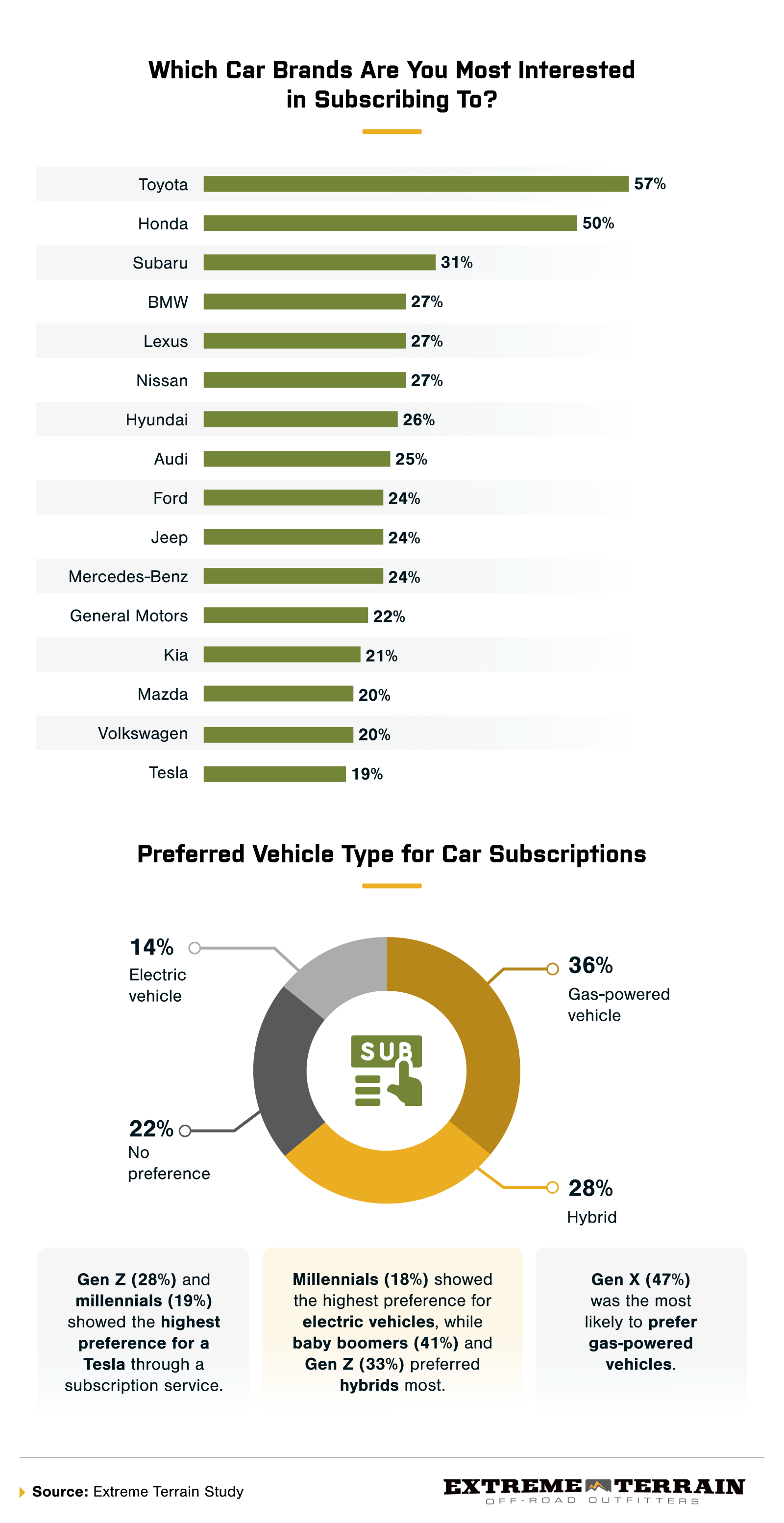

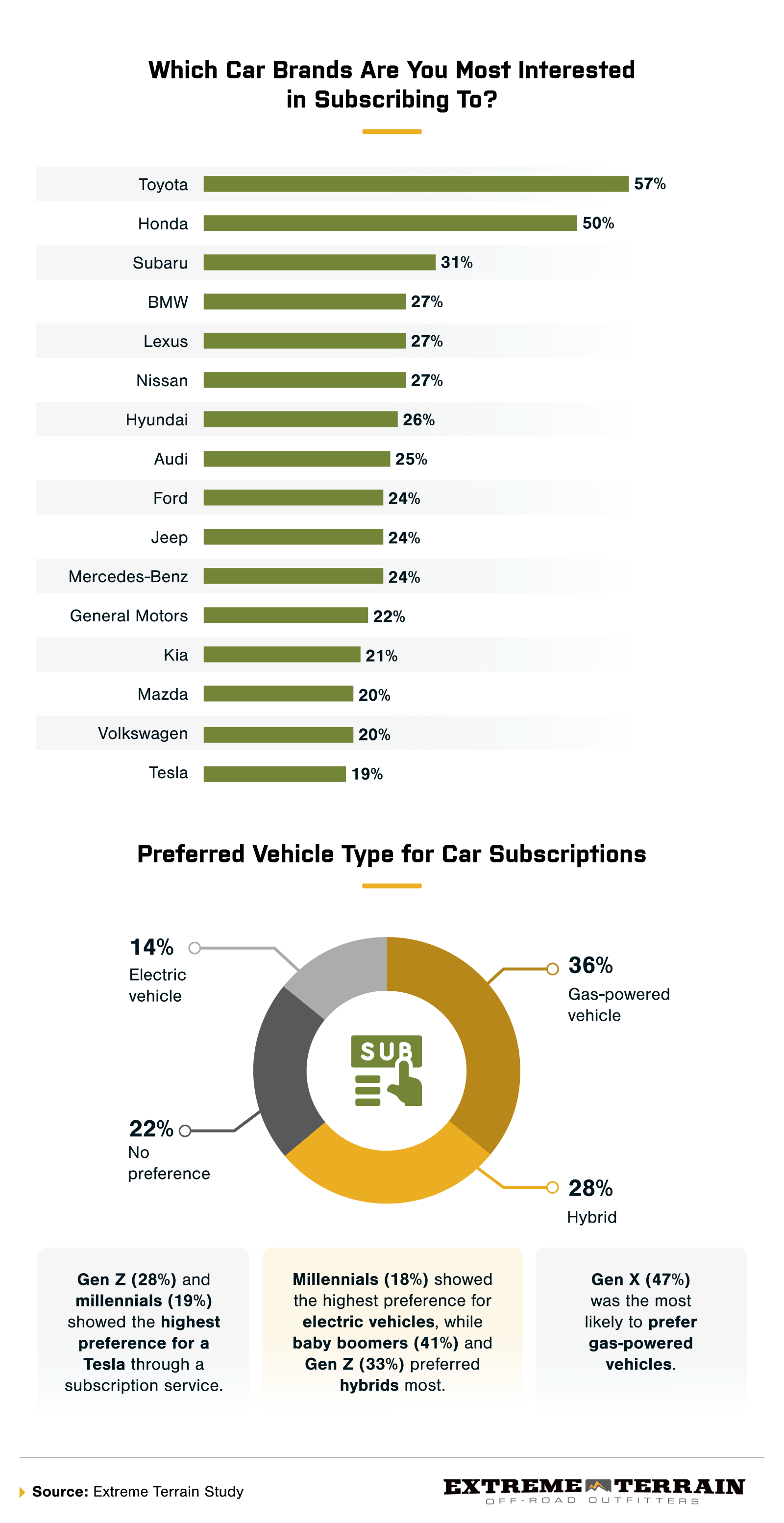

Brand loyalty runs strong in the car subscription space. Toyota topped the list, with 57% of Americans saying they'd be interested in subscribing to one. Honda wasn't far behind at 50%, and Subaru took third at 31%.

Across all generations, Toyota and Honda held the top two spots, but third-place picks showed more personality. Baby boomers (45%) and millennials (30%) preferred Subaru, Gen Z leaned toward BMW (31%), and Gen X would go for Nissan (30%).

Gas-powered vehicles were the top pick for car subscriptions (36%), followed by hybrids (28%) and electrics (14%). About a quarter (22%) didn't have a strong preference either way.

Subscription Flexibility vs. That "Mine" Feeling

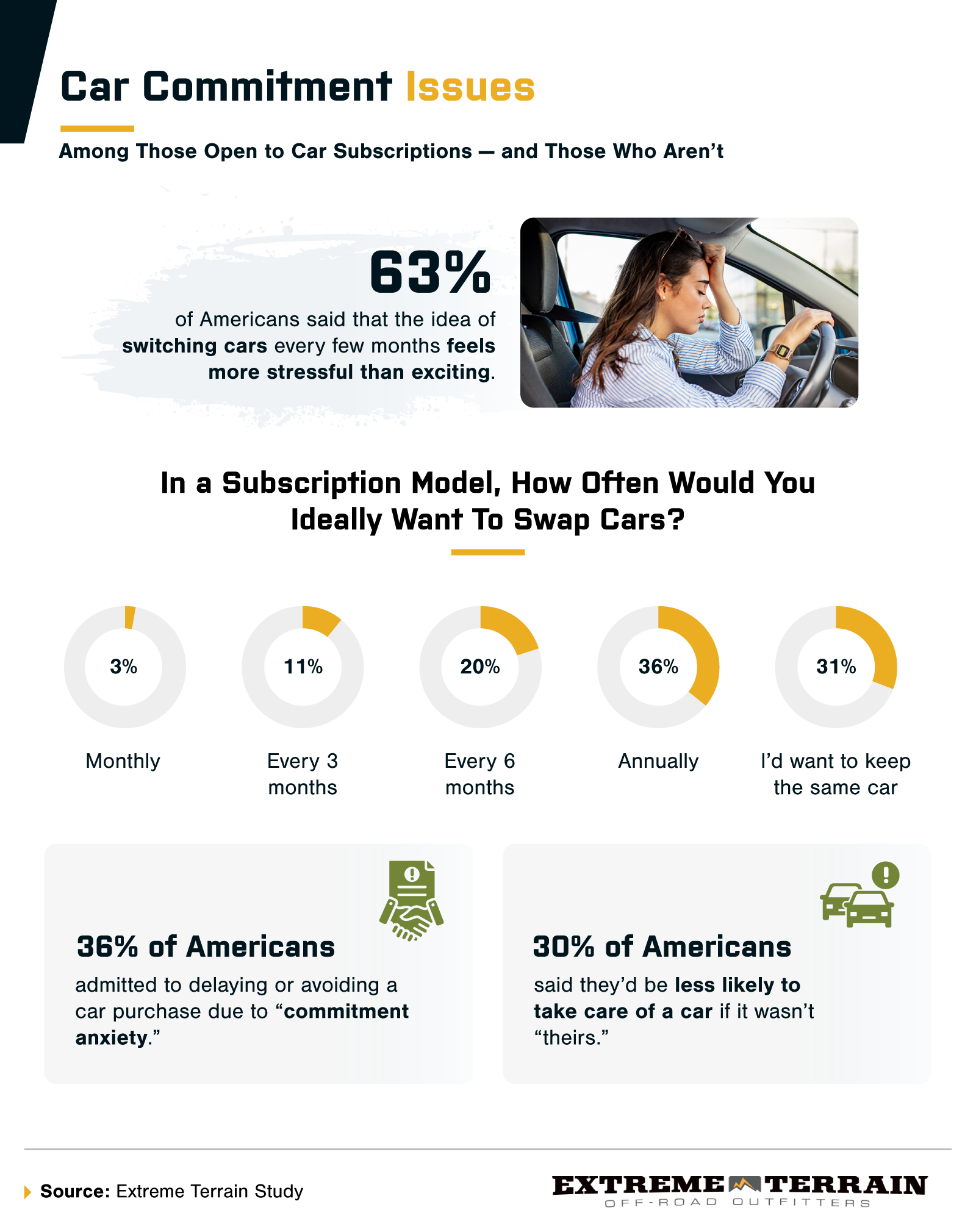

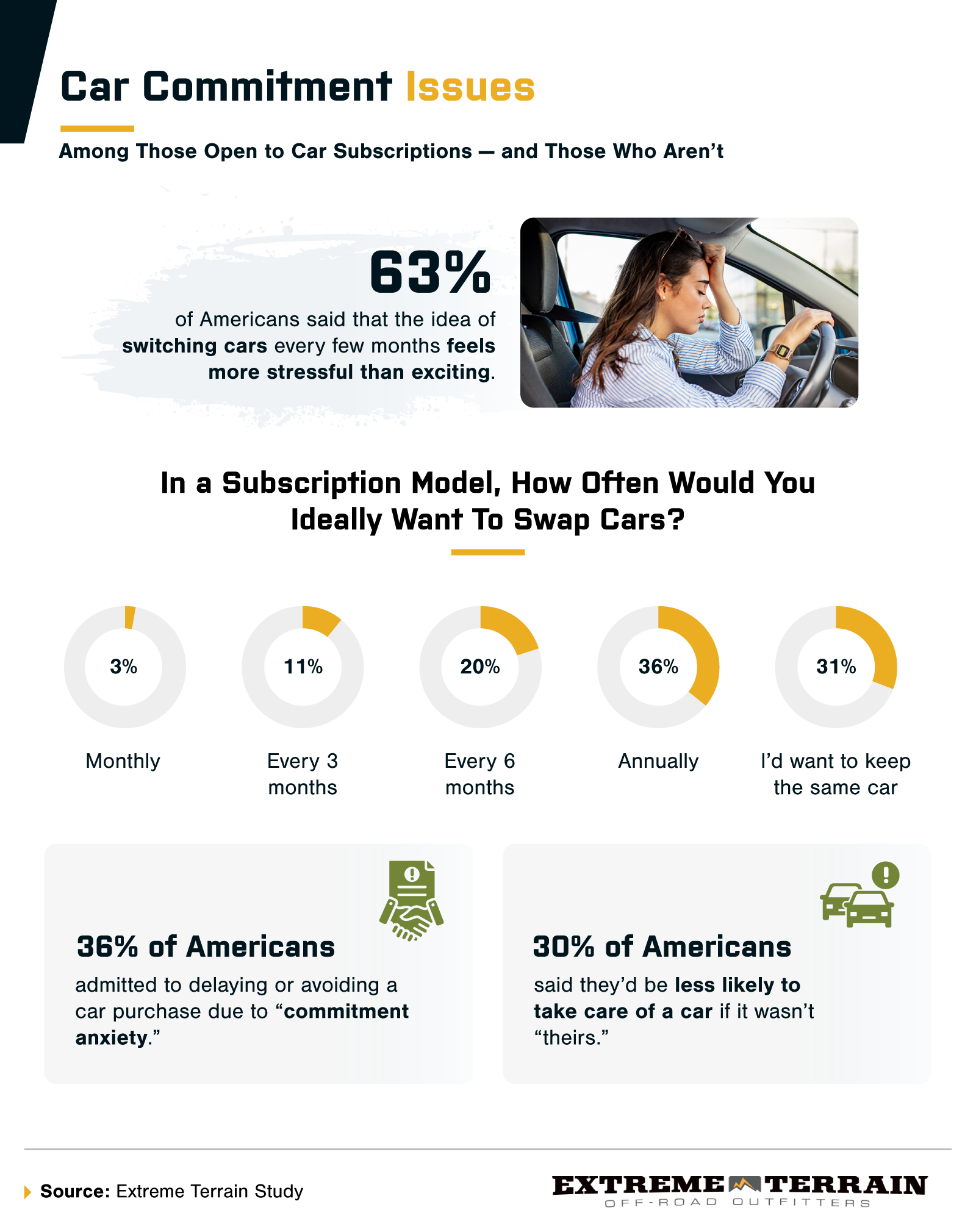

Car subscription services offer flexibility, but most Americans still feel more secure owning a vehicle outright. We next look at how often people would want to switch cars, how rising costs could shift opinions, and how personal responsibility changes when the car isn't truly theirs.

More than 1 in 3 Americans said they'd want to swap cars at least every 6 months under a subscription model. Gen X led that group (38%), followed by millennials and Gen Z (33% each). Only 21% of baby boomers felt the same. Gen Z was the generation most likely to want to keep the same vehicle (41%) throughout their car subscription.

Vehicle ownership remains the most trusted model. Many Americans (84%) felt the most secure owning their car outright, while only 9% felt that way with a subscription and 7% with leasing. If their current vehicle broke down, 46% would buy used, 21% would buy new, and just 8% would consider a subscription.

Rising costs could shift opinions, though. Nearly half of Americans (46%) said they'd be more likely to consider a subscription if tariffs push up traditional car prices. Still, only 13% plan to purchase or lease a vehicle before tariffs take effect, with Gen Z the most proactive at 19%. Some Gen Z drivers also had a different mindset when it came to maintenance, with 34% admitting that they'd be less likely to take care of a vehicle that wasn't truly theirs.

What Drivers Want From Connected Car Services

As automakers roll out more paid connected features (like remote start and in-car Wi-Fi), not every car owner is thrilled about the growing list of monthly charges.

On average, car owners said they'd be willing to spend the most per month on connected car services if they owned a Ram ($90), Ford ($88), or Tesla ($82). Mazda and Nissan drivers followed at $76 and $70, respectively. BMW, Jeep, and Volkswagen owners each hovered just below that, ranging from $69 to $68 per month.

Still, subscription fatigue is real. Nearly 1 in 4 car owners (22%) said they feel overwhelmed by the number of connected car features that now come with a monthly price tag. Jeep fans were especially likely to feel the strain, with 25% reporting they feel overloaded by all the auto-related subscriptions. Gen Z (24%) and millennials (23%) were the most likely age groups to feel worn out by the trend.

Ownership Habits Are Hard to Break

While the idea of subscribing to a car has clear appeal — especially among younger drivers and those seeking flexibility — most Americans still feel more secure owning a vehicle outright. Preferences for brand, vehicle type, and cost tolerance show that interest in subscriptions is there, but so are concerns around commitment, care, and value. Even with rising costs and more subscription options entering the market, traditional ownership remains the standard for now.

Methodology

We surveyed 1,005 Americans to explore how they feel about car subscriptions. Among them, 89% were car owners, and 11% were actively in the market to buy or lease a vehicle in the next 6 months. The generational breakdown was as follows: Gen Z (20%), millennials (50%), Gen X (23%), and baby boomers (7%). The data was collected in April 2025.

About Extreme Terrain

Extreme Terrain is a premier retailer specializing in Jeep parts and accessories. Our experienced team of Jeep enthusiasts is dedicated to providing you with expert service and advice.

Fair Use Statement

If you'd like to share this report or any of our data, please link back to this page to provide proper credit.